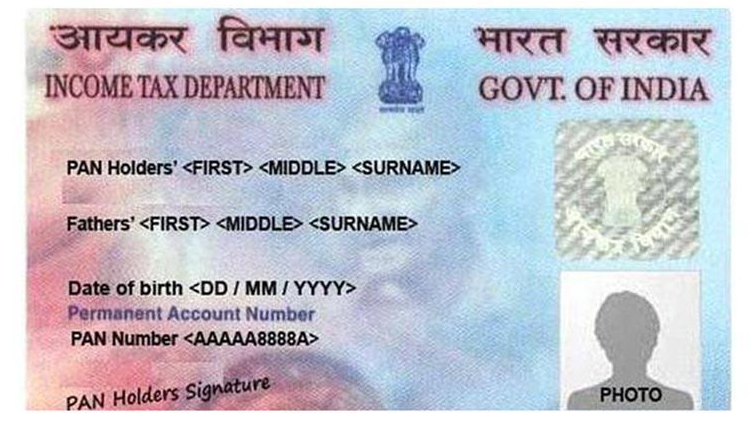

The best court in October lifted restrictions on utilization of Aadhaar card for social welfare schemes and said implementing corporations can use Aadhaar wide variety voluntarily. Pan Card Apply Online

Pension fund regulatory frame PFRDA has started using PAN instead of Aadhaar for validation of new clients who can now be registered on line under the national Pension machine (NPS) scheme.

"PAN (everlasting account number) playing cards will be used as opposed to Aadhaar for on line opening of an NPS account. an online facility for beginning of an NPS account primarily based on verification of PAN and bank KYC has started out," Pension Fund Regulatory and improvement Authority of India (PFRDA) Chairman Hemant G Contractor advised PTI.

The Aadhaar-primarily based on-line NPS account facility become commenced on a pilot basis, however following a splendid court docket judgment on utilization of Aadhaar, it needed to be discontinued.

He stated under the PAN confirmed facility, clients can access their account on the NPS agree with internet site.

"The subscriber having an account with net banking facility with any of the six taking part banks can open his NPS account on line," Contractor said.

The banks in question are country bank of Travancore, kingdom financial institution of Patiala, Oriental bank of trade, United bank of India, South Indian bank and Syndicate bank.

The ideally suited court in October lifted regulations on utilization of Aadhaar playing cards for social welfare schemes and said imposing companies can use Aadhaar numbers voluntarily.

Contractor stated the apex courtroom has allowed usage of Aadhaar for the pension scheme beneath the national Social assistance Programme (vintage Age Pensions, Widow Pensions, disability Pensions), aside from MGNREGA, PMJDY and EPF.

whilst the net facility is predicted to widen PFRDA's reach, people may stand to advantage from quicker replies.

NPS, regulated by PFRDA, has a extensive spectrum of subscribers drawn from important, state, private and unorganised sectors.

in keeping with PFRDA records, as of October 31, 2015, a complete of nine,380,174 were at the subscriber list of NPS. The asset underneath control for the duration of the same period stood at Rs 1,02,878 crore.

Aadhaar-PAN linking explained: what's segment 139AA of IT Act upheld through SC?

The perfect court docket has upheld the required Aadhaar-PAN linking.

The preferrred courtroom on Wednesday declared the Centre's flagship Aadhaar scheme as constitutionally valid and upheld the required use of the precise identity wide variety for allotment of permanent Account quantity (PAN).

The apex court docket, but, struck down some provisions fo Aadhaar scheme such as its linking with bank debts, cellular telephones and school admissions.

A five-decide constitution bench headed by using leader Justice Dipak Misra held that while Aadhaar might stay obligatory for submitting of IT returns and allotment of PAN, it might no longer be obligatory to hyperlink Aadhaar to bank accounts and telecom provider vendors can't are seeking its linking of Aadhaar for cell connections.

The linking of PAN with Aadhaar turned into made mandatory by means of inserion of phase 139AA inside the income Tax Act, which was upheld via the verdict suggested by way of Justice A ok Sikri who wrote the judgement for himself, CJI and Justice A M Khanwilkar.

here is what segment 139AA of earnings Tax Act is:

After segment 139A of the profits-tax Act, the subsequent section will be inserted, specifically:—

139AA. Quoting of Aadhaar number.—(1) everyone who's eligible to gain Aadhaar number shall, on or after the first day of July, 2017, quote Aadhaar range—

(i) in the software form for allotment of permanent account range;

(ii) in the return of earnings:

furnished that wherein the man or woman does no longer possess the Aadhaar quantity, the Enrolment identification of Aadhaar software shape issued to him on the time of enrolment will be quoted within the utility for everlasting account range or, as the case may be, in the return of income furnished by means of him.

(2) all and sundry who has been allotted permanent account variety as at the 1st day of July, 2017, and who's eligible to obtain Aadhaar number, shall intimate his Aadhaar wide variety to such authority in such shape and manner as can be prescribed, on or before a date to be notified by the valuable authorities within the authentic Gazette:

furnished that during case of failure to intimate the Aadhaar number, the permanent account range allotted to the individual shall be deemed to be invalid and the opposite provisions of this Act shall follow, as if the man or woman had not implemented for allotment of everlasting account variety.

(3) The provisions of this phase shall no longer apply to such man or woman or class or classes of humans or any nation or part of any nation, as can be notified by the critical authorities on this behalf, within the legit Gazette.

rationalization.—For the functions of this segment, the expressions—

(i) "Aadhaar number", "Enrolment" and "resident" shall have the same meanings respectively assigned to them in clauses (a), (m) and (v) of phase 2 of the Aadhaar (targeted transport of monetary and other Subsidies, blessings and services) Act, 2016 (18 of 2016);

(ii) "Enrolment identity" manner a 28 digit Enrolment identification variety issued to a resident at the time of enrolment. Pan Card Apply Online

Dies ist eine mit page4 erstellte kostenlose Webseite. Gestalte deine Eigene auf www.page4.com

Dies ist eine mit page4 erstellte kostenlose Webseite. Gestalte deine Eigene auf www.page4.com