Right here is the step-by-step guide to updating your minor PAN card into an impartial PAN card. Pan Card Apply Online

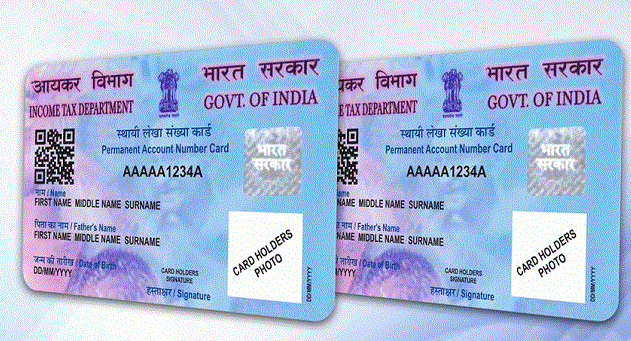

everlasting Account range (PAN) is a 10-digit alphanumeric quantity issued by means of the profits Tax department. It enables the department to hyperlink all transactions of the ‘individual’ with the department. these transactions consist of tax payments, TDS/TCS credit, returns of profits, specific transactions, correspondence, and greater.

PAN card or permanent Account number is one of the most critical documents for the citizens of India. It is not best used for the price of tax however also as an identity proof.

PAN was delivered to facilitate linking of numerous documents, together with payment of taxes, assessment, tax demand, tax arrears and many others. to facilitate easy retrieval and tallying of records. consequently, making it easier for detecting and combating tax evasion of the tax base.

students can observe for a PAN card after turning 18 years. within the cases of a minor (more youthful than 18 years vintage), dad and mom can follow for the PAN card on their behalf. there is no most age restriction to apply for a PAN card.

A PAN card issued for a minor does now not have the minor’s picture or signature, consequently, it can not be used as a valid identification evidence. After a minor turns 18, the essential modifications ought to be made in the PAN statistics.

To get a brand new card with a signature and picture issued, comply with the stairs:

Step 1: replenish the ‘Request for new PAN card and/or modifications or correction in PAN records' shape by clicking here.

Step 2: mention the prevailing PAN number in the utility and take a look at the ‘photo mismatch’ and ‘signature mismatch’ packing containers, and publish the web shape.

Step 3: The form desires to be published out and signed via the applicant. Then post snap shots.

Step four: grant the identity and cope with proof along with Aadhaar card, passport, voter identification or financial institution account statement along side the application shape.

Step five: Pay Rs 107 because the fee either by means of the means of internet banking or by using credit score/debit card.

Step 6: As every other choice, a call for draft of Rs 107 drawn in favour of NSDL-PAN ought to be connected with the software.

Step 7: The applicant will acquire an acknowledgement number after submitting the online shape. The finalized application should be dispatched to the closest NSDL or UTISL-authorised centre.

crucial:

The fame of the software can be tracked by way of bringing up the acknowledgement quantity.

If required, an change to the PAN facts (along with address or name exchange, and many others.) can be executed on the identical time, by way of filing the applicable documents.

The applicant wishes to confirm that the evidence of address, identification, and many others. is valid.

If the PAN card is misplaced or broken, you will get it again; right here’s how

The Union authorities has made it obligatory that the everlasting Account range (PAN) is needed for any financial transaction such as commencing a bank account, investing, transacting, and so on. therefore, each card holder need to keep it accurately. however, if the PAN card is lost both lost or is broken, the card may be reprinted all over again.

that allows you to reprint your lost or damaged PAN card you have to observe the beneath given system.

situations

The reprint of a PAN card is possible if there may be no trade in the details of the card. This facility can be availed via the PAN card holders, whose new PAN utility become processed thru NSDL e-Gov or who took PAN the use of the PAN immediate e-PAN facility on the profits Tax department’s e-filing portal.

those who want to reprint their PAN card can make the online utility by means of clicking on the legitimate internet site (https://www.onlineservices.nsdl.com/paam/ReprintEPan.html).

A request form must be packed with details like PAN wide variety, Aadhaar range, date of birth and so on. The applicant have to additionally agree to apply the Aadhaar info for reprinting the card. Captcha authentication may be required to put up the form.

Expenditure

the cardboard holders who live in India will must pay Rs 50 at the same time as human beings in overseas should pay a fees of Rs 959 to reprint the PAN card. The reprint card will be despatched most effective to the address to be had inside the income Tax department database.

matters to keep in thoughts

If an application for a brand new PAN turned into made on the UTIITSL website, the application for reprint will be made at the following link: https: //www.myutiitsl. com / PAN_ONLINE / domestic print.

The updated cell wide variety and PAN record within the file have to be the identical. Pan Card Apply Online

Dies ist eine mit page4 erstellte kostenlose Webseite. Gestalte deine Eigene auf www.page4.com

Dies ist eine mit page4 erstellte kostenlose Webseite. Gestalte deine Eigene auf www.page4.com